Less Time on Payroll. More Time on People.

From new hire setup to retirement reporting, we take care of the details so your team gets paid accurately and on time. Our partnership with Inova Payroll brings everything into one system that handles payroll, benefits, and compliance so you can stay focused on your mission.

Confidence in every paycheck

Our payroll and benefits expertise provides stability at the core of your organization, ensuring compliance, building trust with staff, and giving leaders the ability to plan ahead.

Payroll shouldn’t be stressful

Processing payroll is high-stakes work. A missed deadline or coding error can ripple across your organization. That’s why we manage the details: schedules, terminations, deductions, and compliance, so your team stays protected and your staff gets paid on time and accurately.

Why It Matters

- Avoid costly errors and late filings

- Ensure on-time, accurate pay for every employee

- Reduce the burden on your HR and Operations staff

- Stay compliant with labor laws and retirement rules

A smarter system, seamlessly integrated

Through our partnership with Inova Payroll, you gain access to a full human capital management platform that connects payroll, time tracking, onboarding, and benefits. With everything in one system, your operations run smoother and your data stays cleaner.

Key Benefits

- Consolidate payroll, time, and benefits in one system

- Improve visibility into pay runs and approvals

- Cut down on manual errors and compliance risks

- Save time and reduce software costs

Already using another platform that you love? Inova is Charter Impact’s preferred payroll provider because it offers a charter-specific platform and often delivers cost savings, but we process payroll in other systems for clients who prefer to stick with their current payroll platform.

Comprehensive support from start to finish

Build and maintain payroll schedules aligned with labor laws and contracts

Process new hires, terminations, bonuses, and supplemental payroll runs

Track and validate timesheets, PTO, and benefits

Set up & manage retirement deductions across STRS, PERS, 403b, 457, and 401a

Handle garnishments, benefits audits, and verification of employment

Review payroll taxes and oversee quarterly and annual filings

Submit accurate W-2s, W-3s, and 1096 forms

Generate detailed payroll journal entries for real-time reporting

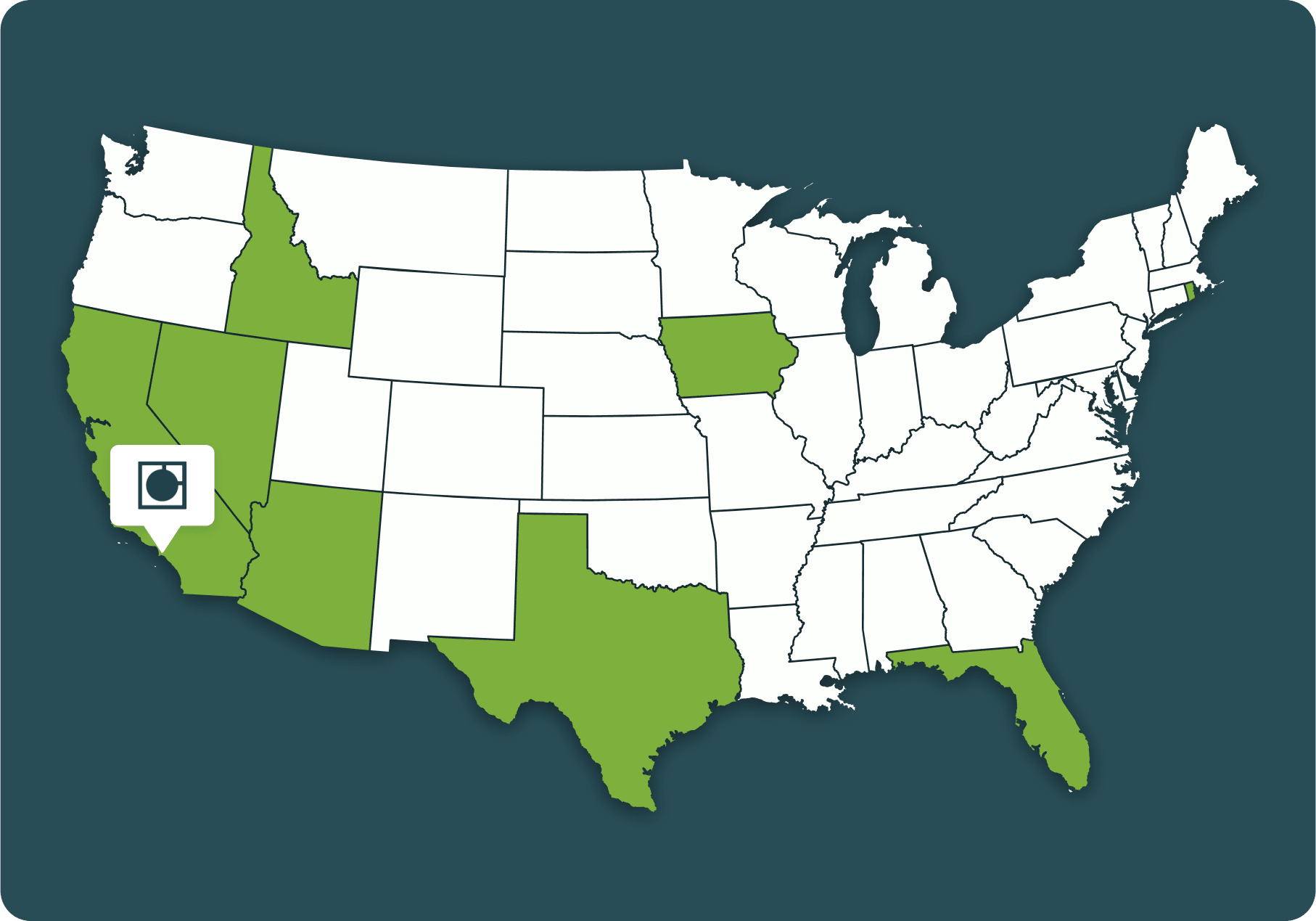

Serving mission-driven organizations across the U.S.

Every charter school is different, and state rules shape everything from funding to reporting calendars, payroll requirements, and grant compliance. Our support adapts to your landscape with budgeting models, templates, and guidance aligned to your state’s laws and authorizer expectations. Explore what matters where you operate, from cash flow timing to audit prep and student data reporting.

FAQs

What payroll services does Charter Impact provide for charter schools?

Charter Impact manages every aspect of payroll and retirement reporting for charter schools, including payroll processing, tax compliance, garnishments, benefits, and supplemental payroll runs, ensuring staff are paid accurately and schools remain fully compliant.

Does Charter Impact process payroll in-house?

Yes. Our team manages payroll processing using our preferred provider, Inova, and we handle all related filings, reports, and retirement plan submissions on your behalf. Our team can also process payroll in a number of other payroll systems if clients prefer to stay with their current provider.

Do you handle 1099s, W-2s, and tax filings for contractors and staff?

Yes. We prepare and file 1099s for contractors and W-2s for staff as part of our standard payroll services, ensuring accurate, timely reporting and compliance with IRS and state requirements.

Do you support STRS/PERS retirement reporting?

Yes. We’re deeply experienced in CalSTRS and CalPERS reporting and ensure timely, accurate submissions and reconciliations for our California clients.

Do you offer help with employee onboarding?

While we don’t serve as a direct HR provider, we work closely with your HR team or partner to ensure payroll and retirement processes are integrated and efficient, and we can present options for full-package HR support through our partners.

Can you help us fix past payroll or retirement reporting issues?

Yes. We can support clients with historical cleanups and audits to ensure records and submissions are corrected and compliant on a per-project basis.

Do you support STRS/PERS retirement reporting?

Yes. Our team has extensive experience managing CalSTRS and CalPERS reporting, delivering accurate, on-time submissions and reconciliations for California schools. We also support a range of state-specific retirement programs, ensuring compliance wherever our clients operate.